Pacific Panel Workshops

Takaful Malaysia Panel Workshops

Toll Free : 1 800 88 1138 (Non Life)

MSIG Panel Hospital List

What is No Claim Discount (NCD)?

The No Claim Discount (NCD) is a reward scheme received by motor policy holders for not making a claim during the preceding 12 months.

How much of No Claim Discount (NCD) am I entitled to?

Consumers are eligible for NCD ranging from 0% to 55% of the premium payable depending on the type of vehicle, coverage and number of years claim not intimated. For a private car, the scale of NCD ranges from 0% to 55% as provided in the policy/certificate whereas for motorcycles and commercial vehicles, it ranges from 0% to 25%.

Find out the current insurer for your vehicle, type of coverage, policy period and policy number by entering your details

Malaysia Motor Insurace, Malaysia Construction Insurance, Malaysia Strata Title Insurance, Malaysia Group Medical and Health Insurance - ACPG Management Sdn Bhd

|

|

|

|

|

Give our Expert Opinion On Your Risks.

How To Handle The Risks.

Provide The Best Insurance Solutions.

Provide Competitive Premium.

Handle Insurance Claims With Comprehensive Homework.

Work Closely with Insurance Adjusters, Insurer Claim Officers and Policy Holders.

Assisted Claims

18/01/2019

ACPG Year 2019 Business Announcement

ACPG 2019 New Insurance Business Channel Project

1) Strata Title Insurance and JMB Insurance Enhancement Program.

Arranged By

ACPG Management Sdn Bhd

www.acpgconsultant.com

HQ +603-92863323

Whatsapp Customer Service Team

+6011-12239838 (Whatsapp Enquiry)

Shared By

Anthony Chin

CEO, ACPG

Malaysia Foreign Worker Insurance Scheme

WhatsApp for Enquiry, please click here...

http://wasap.my/+601112239838/Foreignworkerinsurance

Our ACPG WhatsApp Team

http://wasap.my/+601112239838/Foreignworkerinsurance

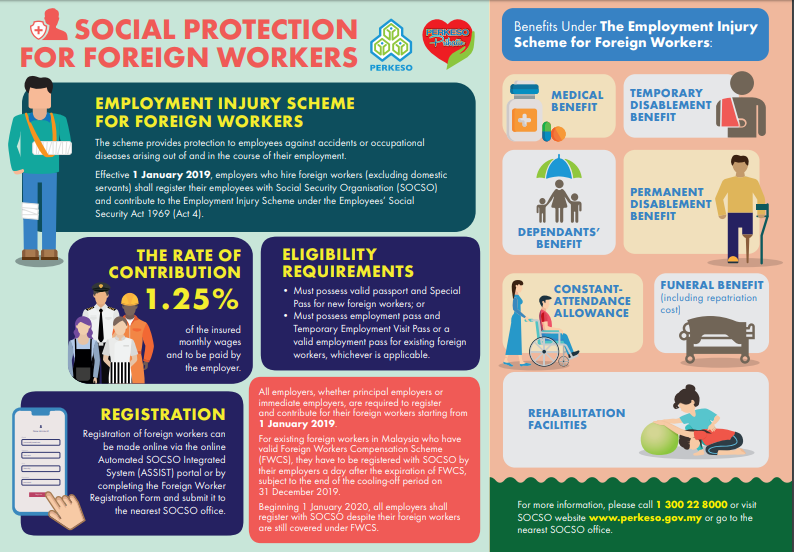

Sharing Topic For Malaysia Foreign Worker Insurance Latest Update in Year 2019

Replacement Foreign Workers Compensation Scheme (FWCS) to SOCSO Employment Injury Scheme

Starting 1 January 2019, Replacement Foreign Workers Compensation Scheme (FWCS) to SOCSO Employment Injury Scheme. SOCSO will take over the compensation for foreign workers according to the provision under the Employees’ Social Security Act 1969 (Act 4) covering the Employment Injury Scheme only.

OBJECTIVE

The purpose of this Circular is to inform all employers regarding the registration procedure, submission of contribution records, payment of contribution and processing of benefit claims for foreign workers with effect from 1 January 2019.

BACKGROUND

1) From April 1993, accident compensation for foreign workers came under the Workmen's Compensation Act 1952 (Act 273) which was enforced by the Department of Labour.

2) With effect from 1 January 2019, SOCSO will take over the compensation for foreign workers according to the provision under the Employees’ Social Security Act 1969 (Act 4) covering the Employment Injury Scheme only.

EFFECTIVE DATE OF IMPLEMENTATION

1) All foreign workers with valid insurance coverage under the Foreign Workers Compensation Scheme (FWCS), the Department of Labour Peninsular Malaysia (JTKSM), Sabah and Sarawak will continue to be covered under the FWCS until the expiry date in 2019.

2) The coverage of SOCSO’s Employment Injury Scheme will only take effect after the expiry of FWCS coverage.

3) If the maturity date of FWCS extends beyond 2019, the Employment Injury Scheme will automatically apply to all employers who employ foreign workers starting from 1 January 2020.

4) For new foreign workers working in Malaysia beginning on the 1 January 2019, employers must directly register them with SOCSO under the Employment Injury Scheme.

APPLICATION

1) The registration procedures, submission of contribution records, payment of contribution and processing of benefit claims for foreign workers and their dependents are similar to the existing process for Malaysian citizens and permanent resident workers under Act 4. However, the following steps should be taken as follows:

a) Foreign Workers Registration

i. Employers must register their foreign workers via ASSIST portal or complete the Foreign Worker Registration Form as in Attachment A and submit it to the nearest SOCSO office.

ii. Foreign workers are eligible to be registered with SOCSO if they possess valid working permits or equivalent documents issued by the Immigration Department of Malaysia.

iii. Employers must submit supporting documents such as a photocopy of the front page of the passport containing employee details, valid working permit or entry permit or equivalent documents for SOCSO’s use.

iv. All foreign workers must register to obtain the Foreign Worker Social Security No. (12-digit KSPA No.), which is compulsory for the submission of employee contribution record.

v. The 12-digit KSPA NO. must be referred to when dealing with SOCSO on all matters related to foreign workers despite any subsequent changes to the worker’s passport details, valid working permit or equivalent document in the future.

b) Submission of Foreign Worker Contribution

i. Employers must make contribution payment based on the Second Category for the Employment Injury Scheme under Act 4, which is for the employer’s share only as in Attachment B.

ii. All foreign worker contribution payments must be made online through the ASSIST Portal or internet banking by using KSPA No.

c) Claims

i. All foreign workers benefit claims must submit a complete Foreign Worker Claim Notification Form as in Attachment C, together with supporting documents, and not using the existing Form 34.

ii. Foreign workers are not eligible to claim for education loan benefit, vocational rehabilitation, dialysis treatment that is not under the Employment Injury Scheme, and Return to Work programme.

iii. Foreign workers who die in Malaysia due to employment injury and are buried in their country of origin, are eligible for RM6,500 in Funeral Benefit.

iv. Other than the situation above, Funeral Benefit under the Employment Injury Scheme will be RM2,000 and is paid to eligible dependents. If there are no dependents, the amount of Funeral Benefit will be based on the amount stated in the funeral receipt, or whichever is lower.

QUERIES

If there are any enquiries regarding this Circular, please contact SOCSO Customer Service Centre, Headquarters (HQ) at 1300 22 8000.

Employers can also visit Socso official website, www.perkeso.gov.myor go to the nearest SOCSO office for more information.

SOCIAL SECURITY ORGANISATION

MENARA PERKESO

281, JALAN AMPANG

50538 KUALA LUMPUR

1300 22 8000

Employers still Compulsory need to purchase insurance scheme as below

Foreign Worker Insurance Scheme (FWIG)

Why do I need FWIG?

Mandatory cover for your foreign worker

Taking good care of your workers will ensure the smooth running and success of your business operations. Foreign Worker Insurance Scheme, will take care of the needs of your foreign workmen while protecting your business from disruptions in the event of illnesses or accidents.

Foreign Worker Insurance Guarantee (FWIG)

Foreign Worker Insurance Guarantee is a guarantee required by Immigration Department under Regulation 21 of the Immigration Regulations from Employers as a security deposit for the employment of foreign workmen in various sectors.

In the event that any of the foreign workman(men) is/are to be repatriated to their home country, this insurance serves as a guarantee to the Director General of Immigration Department up to the maximum aggregate sum of the guarantee value.

The Insurance Guarantee offered under this scheme does not include foreign maids.

Why do I need FWHSS (SKHPPA)?

Mandatory cover for your valuable asset

Taking good care of your workers will ensure the smooth running and success of your business operations. Foreign Worker Insurance Scheme, will take care of the needs of your foreign workmen while protecting your business from disruptions in the event of illnesses or accidents.

Foreign Worker Hospitalisation & Surgical Scheme (FWHSS) SKHPPA

In view of increasing Hospital and Surgical charges, this Scheme is specially designed to reduce the financial burden of the Employers of foreign workers in the event of hospital admission of their foreign workers due to accident or illness.

Foreign Worker PA Benefits During ON and OFF Duty with 24 hours Coverage

Employers available option to purchase a supplementary Personal Accident (Foreign Worker PA) cover for foreign workers has been developed to provide 24 hours protection.

Details of cover are as below:

Accidental Death RM 25,000.00

Permanent Disablement RM 25,000.00

Medical Expenses RM 1,000.00

Funeral Expenses /

Repatriation of Mortal Remains RM 5,000.00

Cover

Cover 24 hours PA Coverage

Eligibility

Foreign Workers with valid passport and working permit.

Premium Rate

RM 60.00 per annum

Subject to 6%SST and RM 10 Stamp Duty per policy.

Malaysia Foreign Workers Insurance Scheme

Arranged By

ACPG Management Sdn Bhd

+603-92863323

Whatsapp Enquiry Hotline +6011-12239838

Arranged By

ACPG Management Sdn Bhd

www.acpgconsultant.com

+603-92863323

MSIG E-Hailing Motor Insurance

MSIG First To Launch Approved E-Hailing Motor Insurance

E-Hailing Drivers Can Now Protect Themselves and Their Passengers

Kuala Lumpur, 12 December 2017 –

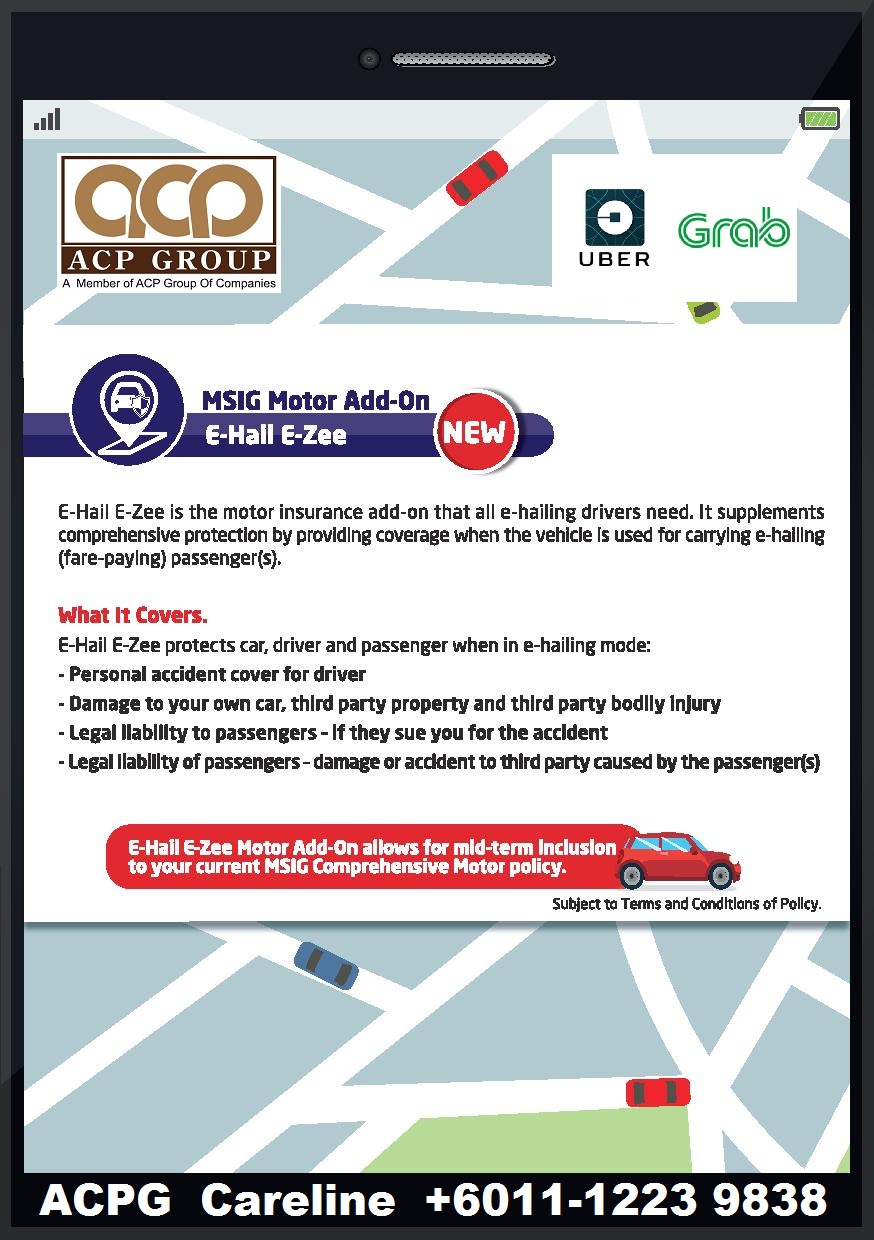

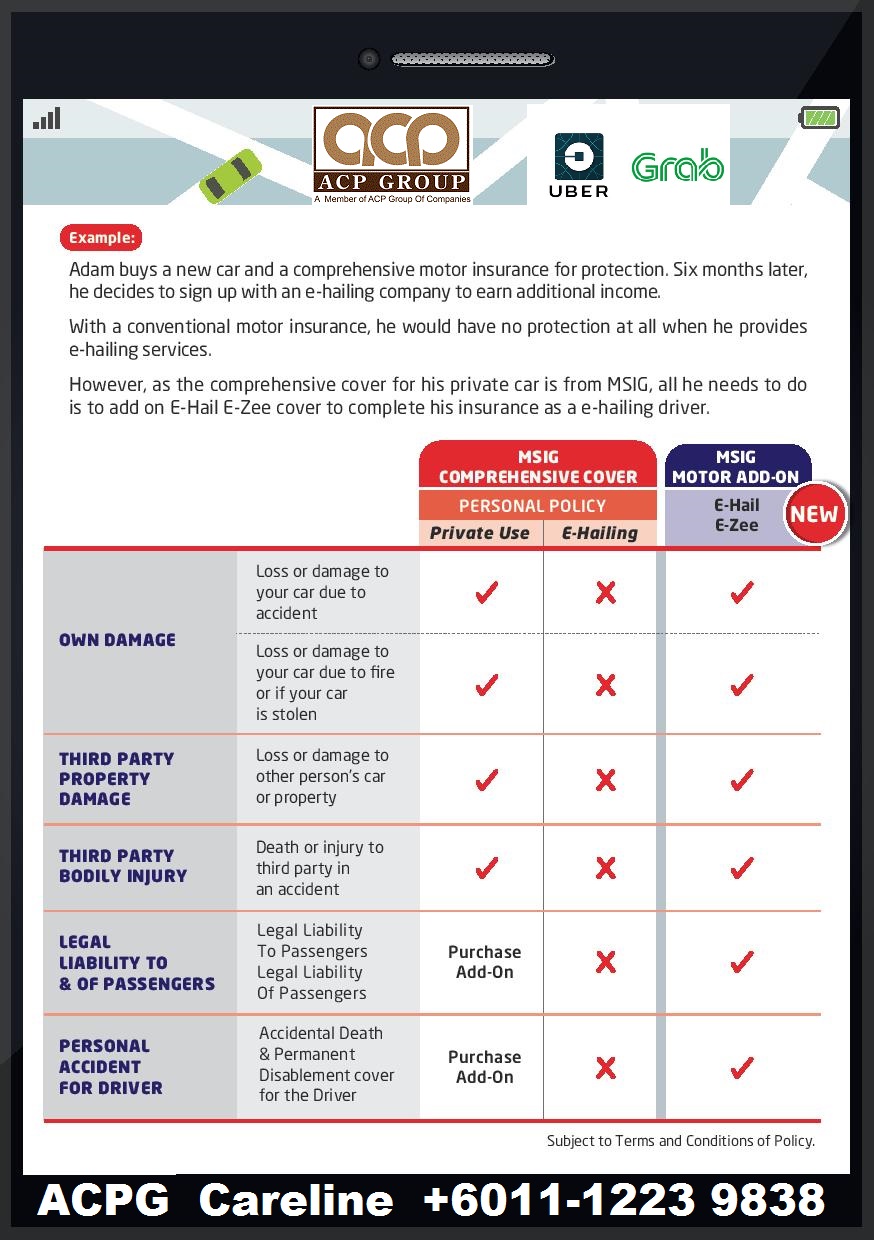

MSIG Insurance (Malaysia) Bhd (MSIG Malaysia) has launched E-Hail E-Zee, a new motor insurance add-on that is the first in Malaysia to provide e-hailing drivers with peace-of-mind in the event of an accident while they are providing e-hailing services.

"Many drivers assume that their standard comprehensive insurance covers them in the case of an accident when providing e-hailing services, but this is not actually the case.

Until now, drivers providing e-hailing services were at great risk of substantial financial losses if they have an accident while carrying passengers, not only from damage and injuries caused by the accident itself, but also from potential legal action by passengers if they sue the driver.

Understanding the gap in the current motor policy, MSIG is proud to launch E-Hail E-Zee, allowing e-hailing drivers to protect themselves and their passengers,” said Mr Chua Seck Guan, MSIG Malaysia Chief Executive Officer.

MSIG has been liaising with various parties such as Bank Negara Malaysia and Persatuan Insurans Am Malaysia (PIAM) to create this approved add-on insurance which will enable e-hailing drivers to enjoy peace-of-mind while working.

"It has been reported* that new laws will come into place in the near future which will require e-hailing drivers to ensure that they are properly insured for e-hailing services, but they can actually purchase our E-Hail E-Zee insurance right now.

This will give them immediate protection and will still be valid when the new regulations come into force, so there is no reason for e-hailing drivers not to sign-up straight away,” said Mr Chua Seck Guan.

MSIG E-Hail E-Zee motor insurance add-on will provide authorised e-hailing drivers with the following cover when they are providing e-hailing services:

Loss or damage to the vehicle due to accident

Loss or damage to the vehicle due to fire or theft

Loss or damage to third-party’s vehicle or property

Death or injury to third-party involved in an accident

Legal liability to passengers and legal liability of passengers

Accidental Death or Permanent Disablement to the driver

The ‘Legal Liability of Passengers’ element covers unexpected negligent acts carried out by the passengers, beyond what it is reasonable for the driver to control. This could include, for example, a passenger suddenly opening their door without checking - resulting in an accident, damages or injury to other vehicles or pedestrians.

The cost of MSIG’s E-Hail E-Zee cover will vary depending on several factors, including the vehicle’s sum insured and the policyholder’s details, as it is risk-based. However, it will still be a relatively affordable add-on to the driver’s existing comprehensive insurance coverage. For example, a standard vehicle that is below 1.5 CC with full 55% No-Claim-Discount (NCD) can enjoy the coverage with an additional premium ranging between RM0.30 to RM0.70 a day.

Mr Chua Seck Guan, concluded, "It is wise to have coverage to minimize the financial losses in the event of accident. E-hailing drivers can also worry less as they can continue to enjoy the same value-added services of MSIG’s Motor Assist Programme for vehicle breakdowns or accidents.”

The introduction of MSIG’s E-Hail E-Zee is one of a number of new motor insurance add-ons that MSIG has launched since the liberalisation of motor insurance earlier this year. These add-ons include: Waiver of Betterment Cost, Limited Special Perils, Smart Key Shield and Driver’s Personal Accident Insurance. They are intended for customers who want more peace of mind and to cover gaps in their current coverage.

*Reference: https://themalaysianreserve.com/…/laws-regulate-e-hailing-…/

Shared By

Anthony Chin

CEO, ACPG

www.acpgconsultant.com

The Star Online, Tuesday, 11 July 2017.

KUALA LUMPUR: AXA Affin General Insurance Bhd has become the first insurance company to take advantage of the detariffed auto insurance environment by launching its AXA FlexiDrive, Malaysia’s first telematics-based motor insurance.

The technology would help drivers better understand their driving behaviour through the installation of a special tracking device and the use of the AXA FlexiDrive mobile app in an insured vehicle.

Discounts of up to 20% of the premiums can be offered upon renewal of a motor insurance policy with AXA Affin depending on the driver’s behaviour that takes into consideration speed, mileage and harsh driving.

"We give you benefit discounts if you drive well but we do not penalise the driver if he does not drive so well. We do not penalise drivers by raising their premiums,” AXA Affin General Insurance’s chief transformation & operation’s officer management Rohit C Nambiar said at a press conference during the launch yesterday.

Users have to pay a security deposit of RM70 for the telematics device but AXA Affin said other devices that are in the market or already installed in vehicles would also be accepted provided they meet a certain technical standard and is compatible with the system.

Malaysia is the first country in the Asia Pacific Region in which AXA Affin operates in to have such a telematics technology for its motor insurance.

The technology also offers peace of mind while driving with round a clock vehicle security and theft recovery system in which users receive real-time alerts when any vehicle faces sabotage or damage is detected.

In cases of theft, AXA Affin will work with the police to recover the stolen vehicle upon receiving the police report.

The telematic technology also gives users enhanced safety on the road where in the event of accidents an alert will be automatically triggered and upon verification, an emergency medical assistance will be dispatched to the exact crash location.

AXA Affin presently has this telematic technology as an insurance option in more than 11 countries over the world.

"We did a test in Malaysia before this launch for one million km on 144 vehicles. Over the period of eight months we’ve only had two minor accidents but more importantly we noticed that people have become more aware of their driving behaviour,” Rohit said.

"This is the power of telematics, where suddenly someone like me who thinks I am a good and safe driver realises that I am not such a good driver after all. Stolen cars can also be recovered in just a short span of time,” he added.

Shared By

Anthony Chin

Chief Executive Officer

ACPG Management Sdn Bhd

Insurans Motor AXA, Insurans Kereta AXA,

AXA Malaysia Motor Insurance, AXA Motor Insurance Cheras, AXA Motor Insurance Ampang, AXA Motor Insurance Kuala Lumpur, AXA Motor Insurance Selangor

Arranged By

ACPG Management Sdn Bhd

158-3-7, Kompleks Maluri,

Jalan Jejaka, Taman Maluri,

55100 Kuala Lumpur, Malaysia.

ACPG Careline +603-92863323, +6011-12239838 (Whatsapp)

Email : enquiry@acpgconsultant.com

#Auto , #Automotive , #AXAAffin , #Telematics , #AXAFlexiDrive , #driver , #motorinsurance, #axamotorinsurance, #axamalaysia, #AXAACPG , #axamotorinsurancecheras, #axamercedes,

8TV 八度空间华语新闻11.07.2017

AAGI车险新配套 驾驶态度良好折扣20%

我国车险自由浮动价格机制这个月初开跑,对于拥有良好驾驶态度的车主都期待能从新机制得到额外优惠。

AXA 安盛艾芬保险有限公司就向消费者推介了全新汽车保险配套AXA FlexiDrive,放眼在未来18到24个月内吸引高达4万5千名新客户。

ACPG 最新消息

AXA Flexi Drive 车险配套奖励驾驶良好的车主由ACPG 保险服务管理公司安排

ACPG Management Sdn Bhd

03-92863323

011-12239838 (whatsapp)

第一个远程信息处理汽车保险,奖励您作为安全驾驶车主的程序 !

本地保险公司AXA Affin General Insurance(AAGI) 安盛艾芬保险有限公司, 今天向消费者推介了全新的汽车保险配套AXA FlexiDrive,这个保险配套的特别之处在于保险公司将会在顾客的车子内安装一台检测器,并以此向驾驶态度良好的车主提供保费折扣,同时也可用作防盗和失窃后的追踪用途。

这台小型的侦测器由卫星定位仪(GPS)、SIM卡和将速度侦测器组成,被安装在消费者车子的电池上,它可收集车子的行驶速度、加速和煞车行为表现,以及推算车主的驾驶习惯和态度,保险公司在收集到这些数据后,将会对驾驶行为良好的车主提供高达20%的下一次保险更新费用折扣。

除此之外,这个侦测器也可以实时侦测车子的动态情况,并可判断车子是否发生剧烈撞击,一旦侦测到车身发生剧烈撞击,保险公司将会协助通知紧急单位,并派出救护人员到场提供急救,同时这架侦测器也会侦测车子是否有遭人破坏或企图偷窃,一旦车主向警方报案称车子失窃,保险公司也可透过这架侦测器协助警方寻回失窃的车子。

不仅如此,购买此保险配套的消费者也可在手机下载AXA FlexiDrive的App,用户可在此App内查询本身享有的保费折扣金额、车上电池的电量状况,以及翻阅本身的驾驶数据,包括平均时速等。

购买这份保险配套的消费者是无需额外付费就可以享有以上的服务,消费者只需付70令吉的抵押金(结束后可退款)给保险公司,保险公司就会协助把这架侦测器安装在您的车子上。

当然,保险公司也保证他们透过这台侦测器所收集到的所有数据,包括车子的驾驶方式数据等都不会对第三者公开,仅供保险公司本身的业务用途,并且保证会依据我国个人资料保护法令(PDPA)来处理这些私人资料,而且只有车主本身才可在手机上追踪车子的实时行踪。

分享资讯

Anthony Chin

ACPG 首席执行官

ACPG Management Sdn Bhd

Installation & Dismantle Period, Project Period, Annual Cover Period

*Public Liability Insurance

*Legal Liability Insurance

*Third Party Liability Insurance

Type of Insurance Coverage

- Contractor All Risk Insurance (CAR)

- Erection All Risk Insurance (EAR)

- Public Liability Insurance (PL)

- Workmen’s Compensation Insurance (WC)

- Foreign Worker Insurance (FWCS/FWIG/SKHPPA)

- Machinery All Risk Insurance

- Employer’s Liabiliy Insurance

- Group Accident (PA) & Group Medical (H&S) Insurance

Installation & Dismantle Period, Project Period, Annual Cover Period

*Public Liability Insurance

*Legal Liability Insurance

*Third Party Liability Insurance

Type of Insurance Coverage

- Erection All Risk Insurance (EAR)

- Public Liability Insurance (PL)

- Workmen’s Compensation Insurance (WC)

- Foreign Worker Insurance (FWCS/FWIG/SKHPPA)

- Machinery All Risk Insurance

- Employer’s Liabiliy Insurance

- Group Accident (PA) & Group Medical (H&S) Insurance

*Public Liability Insurance

*Legal Liability Insurance

*Third Party Liability Insurance

Type of Insurance Coverage

- Erection All Risk Insurance (EAR)

- Public Liability Insurance (PL)

- Workmen’s Compensation Insurance (WC)

- Foreign Worker Insurance (FWCS/FWIG/SKHPPA)

- Machinery All Risk Insurance

- Employer’s Liabiliy Insurance

- Group Accident (PA) & Group Medical (H&S) Insurance

- Contractor’s All Risk Insurance

- Erection All Risks Insurance

- Contractor Plant & Machinery Insurance

- Insurance Bond / Bank Guarantee

- Workmen’s Compensation Insurance

- Foreign Workers Insurance

(FWCS / SKHPPA / FWIG)

- Civil Engineering Completed Risks Insurance

- Third Party Liability Insurance

- Acts of God / Flood/ Collapse / Landslide / Landslip / Subsidence

- Fire / Theft

- Designer Risk

- Professional Fees

- Offsite Storage

- Cover for Consultant as Third Parties

- Temporary Storage

- Plans and Specifications

- Extended Maintenance Cover

- Underground Cables, Pipes & Others Facilities

- Extend Cover Contractors or Sub-Contractors

Malaysia Professional Indemnity Insurance

Professional Indemnity Insurance

RM 200,000.00 Coverage

Annual Premium RM 820.00

- Professional Indemnity

- Professional Liability

- Professional Legal Liability

- Management Liability

- Errors and Omissions (E&0)

Scope of Cover:

Professional Indemnity Insurance protects the professional against legal liability to pay damages to persons who have sustained financial loss arising from their own professional negligence or that of their employees in the conduct of the business.

The policy offers indemnity strictly on legal liability basis. In addition to indemnifying the professional insured against his professional liability, a Professional Indemnity Insurance Policy indemnifies him for defense cost and expenses incurred in respect of claim to which the policy applies.

1) Food & Drink Poisoning

- We insure you against legal liability in connection with your business up to RM1,000,000 including legal liability for third party injury.

2) Public Liability

- Insures you against legal liability for third party bodily injury or property damage arising from your business.

3) Employers' Liability

- Safeguard against liabilities in the event of negligence to your employee which occurred during the period of employment.

4) Global Infectious Diseases Clean Up

- We pay a lump sum for global infectious diseases clean up as per Schedule of Benefits.

5) Replacement Cost for Teacher due to Hospitalisation

- We pay RM100 per day for replacement cost of your teacher due to hospitalisation up to 100 days!

6) Theft of Teacher's Belongings

- We insure you against theft of teacher’s belongings up to RM500 per incident.

Foreign Students Medical Insurance Package

(24 Hours and 365 Days Worldwide & Malaysia Coverage*)

Arranged by ACPG Management Sdn Bhd

Foreign Students studied in Malaysia

- More than RM 170,000* Accidental & Medical Insurance Coverage*

Only RM 350 per year premium.

Foreign Students Medical Insurance Policy

Medical & Health Benefits* and Coverage Amount (RM)

1) Room & Board* - RM 300

2) Intensive Care Unit* (ICU/CCU) - RM 500

3) Full Reimbursement As Charge:

- Hospital & Related Services*

- Surgical / Surgeon / Anaesthetist Fees

- Operating Theatre Charges

- Daycare Surgery

- In-Hospital Physician Visit

- Pre-Hospital Diagnostic Tests / Specialist Consultation

- Pre-Hospital Treatment

- Home Nursing Care

- Emergency Accidental Out-patient Treatment

- Emergency Accidental Dental Treatment

- Out-Patient Kidney Dialysis / Cancer Treatment

- Ambulance Fees

- Services Tax / Government Tax

4) Medical Report Fees - RM 80

5) Maximum Limit Per Disability* - RM 50,000

6) Accidental Death & Disablement - RM 50,000

7) Study Interruption / Reimbursement of Tuition Fees - RM 10,000

8) Convalescence Allowances - RM 5,000

9) Repatriation and Transportation of Mortal Remains - RM 5,000

10) Personal Liability - RM 50,000

11) Emergency Medical Advise & Assistance - Covered

12) International Travel Assistance Services - Covered

13) Annual Premium (12 months) - RM 350

This is summary for training proposal only.

* Subject to terms and conditions apply and based on policy coverage.

1) Food & Drink Poisoning

- We insure you against legal liability in connection with your business up to RM750,000 including legal liability for third party injury.

2) Food Spoilage

- We pay a lump sum for food spoilage due to flood as per schedule

of benefits.

3) Fidelity Guarantee

- We insure you against the loss of money or other property due to

fraud or dishonesty commiteed by your employees.

4) Pest Control Coverage

- We pay a lump sum for pest control allowance in the event of flood as per schedule of benefits.

5) Event Cancellation

- We pay a lump sum for event cancellation due to flood or burglary as per schedule of benefits.

6) Employers' Liability

- Safeguard against liabilities in the event of negligence to your employee which occurred during the period of employment.

7) Special All Risk

- Insures your physical assets, including office equipment, furniture, fixtures and fittings against loss or damage caused by fire, perils and accidental causes as covered in the policy term.

8) Fire Consequential Loss

- Indemnifies you against loss of gross profit/gross revenue / wages or the increased cost of working you may incur if your business is interrupted.

Your Trusted Malaysia Risk Management Insurance Advisory Provider since year 1989.